The Daily Raptor

Newsletter Signup: dailyraptor.com

Tuesday, July 22, 2025 Edition

Mentioned in this edition:

Kelly Jones, CPO Cisco Systems / Abnormal Security / CertifID / Business Email Compromise / Wire Fraud / Cybersecurity Poverty Line

Cybersecurity Poverty Line to the Front Lines of Fraud

In last week’s Daily Raptor feature, “Surviving Below the Cybersecurity Poverty Line,” we explored the widening digital divide between organizations with well-funded security operations and those operating with minimal protections. But the real insight came from Kelly Jones, Chief People Officer at Cisco, who reminded us:

“In many of the toughest cybersecurity moments, the hero is the human.”

-Kelly Jones, Chief People Officer at Cisco

That wisdom is especially urgent when it comes to Business Email Compromise (BEC)—a threat category that exploits both digital weaknesses and human vulnerability. For organizations below the cybersecurity poverty line—like title companies, real estate firms, family law practices, doctor’s offices, and M&A attorneys—a single misstep can be financially devastating. Many of these small offices manage tens of millions in transactions each month, yet rely on email chains, outdated processes, and well-meaning but untrained personnel to guard the digital gate.

According to CertifID’s State of Wire Fraud 2025, BEC attacks targeting real estate transactions now account for nearly $500 million in annual losses. These organizations operate in fragmented regulatory environments, handle ultra-high-value transactions, and lack uniform IT infrastructure—making them ideal targets for cybercriminals.

Business Email Compromise: More Than a Tactic—An Entire Threat Category

BEC isn’t just a subset of phishing. It’s a multi-billion-dollar criminal model built on trust manipulation, timing, and precision impersonation—and increasingly, on artificial intelligence.

At its core, BEC uses highly personalized messages (often appearing to come from known contacts or authorities) to trick employees or clients into altering wire instructions, approving fake invoices, or leaking sensitive information.

At its core, this is a human problem—exploiting trust, stress, and oversight under pressure::

Over 1 in 4 homebuyers or sellers report receiving suspicious communications during their closing process

Nearly 1 in 20 fall victim to fraud (source: CertifID)

Victims are often first-time buyers, overwhelmed clients, or solo administrators managing multiple transactions on tight timelines.

And now, we’ve entered a new chapter: the AI-augmented BEC era.

Fraudsters are using generative AI to:

Create authentic-looking emails

Clone voices of agents or attorneys

Generate real-time deepfake video calls

In one 2025 incident, a finance employee transferred $25 million after joining a video call with an AI-generated fake CFO.

The Business Email Compromise Crisis: What Every Business Executive Should Know

Summary:

Soft targets handle trillions in transactions with minimal security budgets

Organizations moving >$10M annually with <$100K in security spend are prime targets

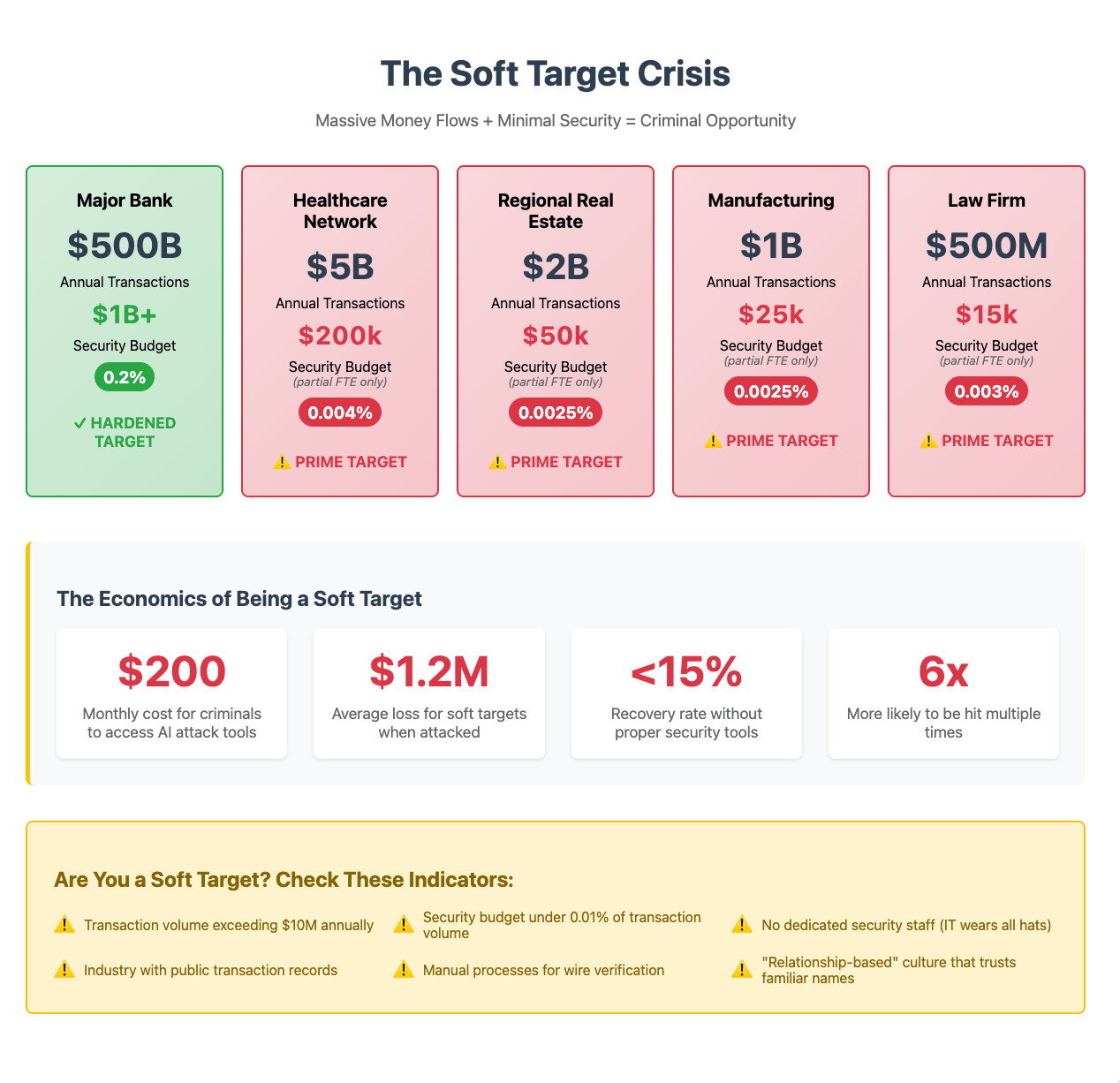

Average BEC loss for under-protected organizations: $1.2M per incident

AI-powered attacks are actively hunting high-value soft targets

Time to implement protection: 90 days

Cost: ~0.1% of transaction volume

Risk reduction potential: Up to 95% with targeted defenses

The Perfect Storm: Maximum Value, Minimal Defense

Your organization moves $50 million monthly via wire transfers—but your email security hasn’t been updated since 2019. You’re not alone.

Across America, sectors moving trillions—many in real estate, healthcare, manufacturing, legal—operate with cybersecurity budgets that wouldn’t protect a retail store.

Real-world examples:

A small law firm managing a $280M acquisition lost $3.7M to BEC. Annual security budget: $15K

A regional healthcare network processing $500M in claims discovered 6 months of diverted payments. IT security: one part-time contractor

A family-owned manufacturing supplier lost $4.2M in one afternoon. Security: a single endpoint tool and “good intentions”

The Soft Target Economy: Where Billions Meet Basic Defenses

Sector Vulnerabilities:

Real Estate: $2.5T annually; 29% of title companies spend <$1K/year on security

Midsized healthcare: $4.3T in transactions, often reliant on outdated email systems

Modest-sized manufacturing: Billions in supply chain value, often no dedicated security staff

Legal/M&A: High-stakes deals via consumer-grade email

Shared Risk Characteristics:

Massive transaction volumes

Legacy technology

Fragmented oversight

Publicly visible transaction data

The Resource Gap Criminals Exploit

Sector | Annual Transaction Volume | Typical Security Budget | Security as % of Volume | Attractive to Attackers? |

|---|---|---|---|---|

Major Bank | $500B | $1B+ | 0.2% | Hardened target |

Regional Real Estate | $2B | $50K | 0.0025% | Prime target |

Healthcare Network | $5B | $200K | 0.004% | Prime target |

Mid-size Manufacturing | $1B | $25K | 0.0025% | Prime target |

Law Firm | $500M | $15K | 0.003% | Prime target |

Why AI Makes Soft Targets Softer

AI doesn't need to breach fortified walls—it finds unlocked doors.

Automated Targeting: Scans public records, identifies valuable targets

Scalable Exploits: Crafts convincing messages in minutes

Team Overload: Outpaces small teams with rapidly mutating attacks

Malicious GPTs: Tools like WormGPT and FraudGPT enable scalable attacks

Low Cost of Entry: $200/month buys powerful AI tools—no hacker degree required

Soft Target Indicators

You're likely a prime target if:

You move >$10M annually

Your security budget is <0.01% of transaction volume

You have no dedicated security staff

You operate in sectors with public transaction records

Your team gets overwhelmed by seasonal spikes

Your culture is relationship-based and trust-driven

Wire verification is manual or inconsistent

There’s no formal security training or simulations

Real-World Carnage: When Soft Targets Get Hit

Case Study: Regional Title Company

Volume: $2.8B/year

Security Budget: $45K

Loss: $4.7M in 48 hours

Aftermath: Shuttered, 47 layoffs, lawsuits

Case Study: Healthcare Processor

Volume: $950M/year

Security Budget: "Whatever IT can squeeze in"

Loss: $8.3M over 6 months

Aftermath: Under federal investigation, CEO resigned

Case Study: Manufacturing Supplier

Volume: $375M/year

Security Budget: $22K

Loss: $2.1M via deepfake video call

Aftermath: Lost 3 major contracts, 20% workforce reduction

The Soft Target Tax: The True Cost of Underprotection

Average BEC loss: $1.2M (for orgs with <$100K security budget)

Recovery rate: <15% without security tools

Time to detect fraud: 73 days (without monitoring)

Repeat attacks: 6x more likely for soft targets

Secondary costs: 3–5x initial loss (legal, trust, reputation)

The Ripple Effects of Soft Target Breaches

When a title company loses $500K, it’s not just their loss. It’s:

A family’s home

A retiree’s life savings

A business’s growth capital

Ripple effects include:

Delayed deals across sectors

Frozen capital

Higher premiums

Collapsing trust

Job loss and industry-wide skepticism

The Realistic 90-Day Plan for Soft Targets

Days 1–30: Triage & Assess

Identify highest-risk transactions

Flag employees handling >$1M transactions

Document wire transfer processes

Calculate soft target score = Transaction Volume ÷ Security Spend

Days 31–60: Targeted Hardening

Deploy AI-driven email security

Enforce mandatory callbacks for (>$10K?) wires

Create “transaction security zones”

Partner with a cybersecurity firm that knows your sector

Days 61–90: Scale Smart

Prioritize protection by transaction value

Train teams using real attack simulations

Build relationships with law enforcement

Create incident response playbooks (BEC, ransomware, wiper attacks)

Consult a partner for industry-specific strategy and tools

Consider insurance coverage, particularly large transactions

The Path Toward a Smart Defense

You don’t need Fortune 500 resources to stop being a soft target.

But you do need to act—because criminals are already acting on you.

The math is simple:

Your annual volume: $100M+

Your security budget: <$100K

Their monthly investment: $200 for AI tools

Their potential gain: $1M–$5M per attack

The question isn’t “Can we afford protection?”—

It’s “Can we afford to stay the weakest link in a trillion-dollar chain?”

The time to act is now—no one wants to be the next case study.

For immediate soft target assessments and industry-specific protection, contact a capable cybersecurity provider who understands (deeply) your risk profile.

Stay cool this week, Raptor Community.

— The DR Team

/smb

Newsletter Signup: dailyraptor.com

An imPAWster revealed…

- The below attachments helped to inform this publication:

/

![[WHITEPAPER] State of Wire Fraud 2025 _ CertifID.pdf](https://media.beehiiv.com/cdn-cgi/image/fit=scale-down,format=auto,onerror=redirect,quality=80/static_assets/file_attachment.png)